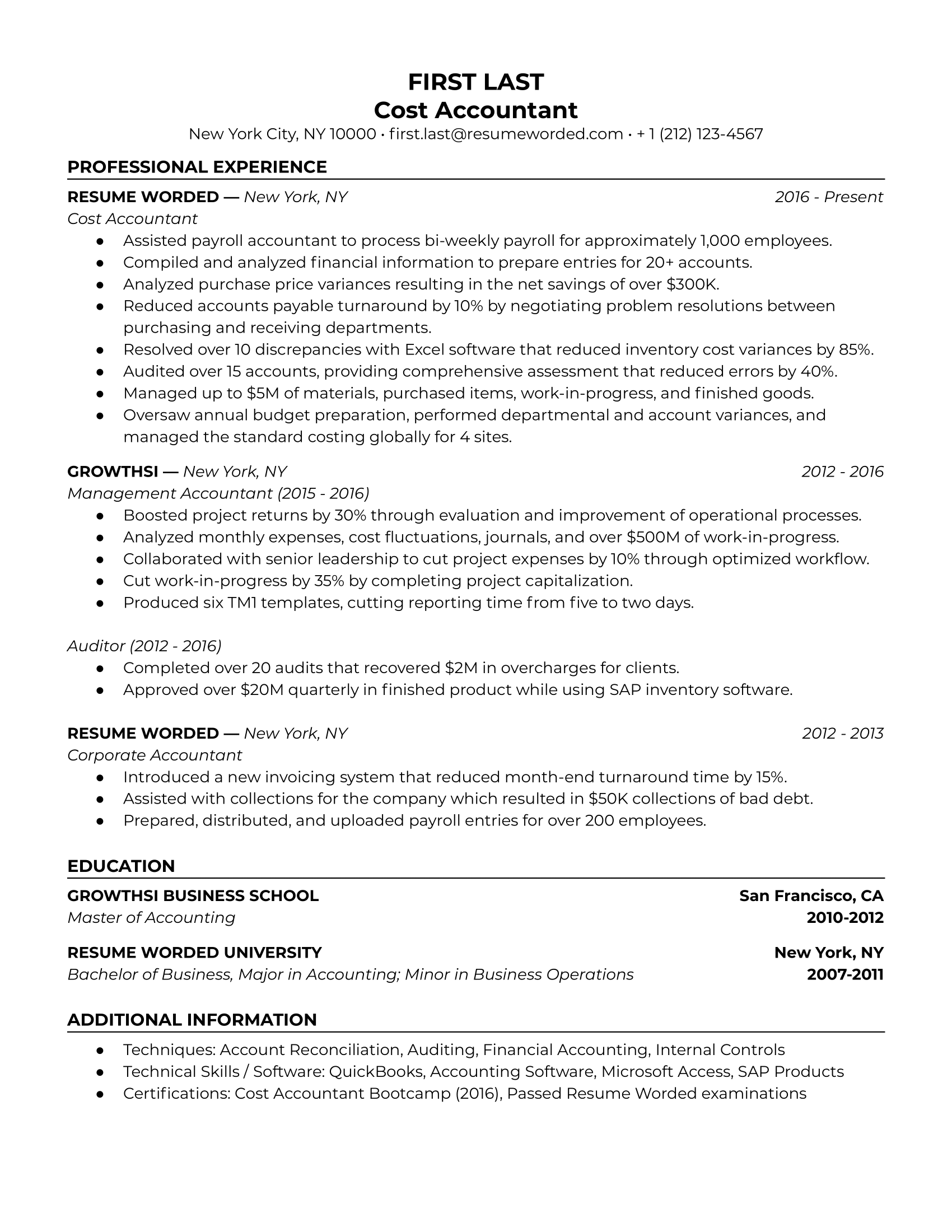

A cost accountant position description outlines the duties, responsibilities, and qualifications required for a cost accountant role within an organization. It serves as a guide for hiring managers and candidates alike, ensuring that expectations are clear and aligned.

Cost accountants play a vital role in managing and analyzing an organization’s financial performance. They provide valuable insights into cost behavior, profitability, and operational efficiency. By leveraging their expertise in cost accounting principles and techniques, cost accountants help businesses make informed decisions, optimize resource allocation, and enhance profitability.

The main article topics will delve deeper into the following aspects of cost accountant position descriptions:

- Duties and responsibilities

- Qualifications and experience

- Education and certification requirements

- Skills and competencies

- Compensation and benefits

- Career advancement opportunities

1. Duties and Responsibilities

Within a cost accountant position description, the duties and responsibilities section holds significant importance, outlining the specific tasks and activities expected of the cost accountant. These responsibilities form the core of the role and directly impact the organization’s financial performance and decision-making.

Duties and responsibilities commonly found in cost accountant position descriptions include:

- Analyzing and interpreting cost data to identify trends, patterns, and areas for improvement

- Preparing financial reports and statements, including income statements, balance sheets, and cash flow statements

- Developing and implementing cost accounting systems and procedures

- Providing insights and recommendations to management on cost-related matters, such as cost reduction strategies

- Collaborating with other departments, such as finance, operations, and sales, to ensure accurate and timely financial reporting

Clearly defined duties and responsibilities in a cost accountant position description serve several purposes:

- Ensuring clarity of expectations: Both the hiring manager and the candidate have a clear understanding of the role’s requirements, minimizing any ambiguity or misunderstandings.

- Facilitating performance evaluation: The duties and responsibilities provide a benchmark against which the cost accountant’s performance can be measured and evaluated.

- Guiding professional development: The outlined duties and responsibilities can help cost accountants identify areas for professional growth and development.

In summary, the duties and responsibilities section of a cost accountant position description is crucial for aligning expectations, evaluating performance, and guiding professional development. It provides a roadmap for the cost accountant’s role within the organization, ensuring that they can effectively contribute to its financial success.

2. Qualifications and Experience

When examining a cost accountant position description, the section detailing qualifications and experience holds significant importance, as it outlines the educational background, certifications, and prior work experience required for the role. This information serves as a benchmark for evaluating candidates’ suitability and their potential to excel in the position.

- Educational Background: Typically, cost accountant positions require a bachelor’s or master’s degree in accounting, finance, or a related field. Coursework in cost accounting, financial accounting, auditing, and economics provides a strong foundation for the role.

- Certifications: Many cost accountants pursue professional certifications, such as the Certified Management Accountant (CMA) or Certified Public Accountant (CPA), to enhance their credibility and demonstrate their commitment to the profession.

- Work Experience: Prior experience in cost accounting or a related field is often required for cost accountant positions. This experience should demonstrate proficiency in cost accounting principles, techniques, and software.

- Skills and Competencies: In addition to technical skills, cost accountants should possess strong analytical, problem-solving, and communication skills. They should be able to interpret complex financial data, identify trends and patterns, and communicate their findings effectively.

By carefully considering the qualifications and experience required for a cost accountant position, organizations can increase the likelihood of hiring individuals who possess the necessary knowledge, skills, and abilities to contribute to the organization’s success.

3. Skills and Competencies

Within a cost accountant position description, the section detailing skills and competencies outlines the specific abilities and qualities required for success in the role. These skills and competencies encompass both technical and soft skills, forming a well-rounded profile that enables cost accountants to effectively execute their responsibilities.

- Analytical Skills: Cost accountants must possess strong analytical skills to examine financial data, identify trends and patterns, and draw meaningful conclusions. They should be able to interpret complex information and translate it into actionable insights for management.

- Problem-Solving Skills: Cost accountants often encounter challenges and problems in their work. They should have the ability to think critically, evaluate alternative solutions, and make sound decisions to resolve these issues.

- Communication Skills: Effective communication is essential for cost accountants. They should be able to clearly and concisely communicate their findings and recommendations to both technical and non-technical audiences, including management, colleagues, and external stakeholders.

- Technical Skills: Cost accountants require proficiency in cost accounting principles, techniques, and software. They should be familiar with cost accounting systems, costing methods, and financial reporting standards.

The combination of these skills and competencies empowers cost accountants to make significant contributions to an organization’s financial performance. Their ability to analyze costs, identify inefficiencies, and provide valuable insights supports decision-making, cost optimization, and ultimately, the achievement of organizational goals.

4. Compensation and Benefits

The “Compensation and Benefits” section of a cost accountant position description outlines the financial rewards and additional perks offered to individuals filling the role. This information is crucial for attracting and retaining qualified professionals and plays a significant role in shaping the overall attractiveness of the position.

- Salary: The salary range for cost accountants is typically commensurate with their experience, qualifications, and industry. Location and company size can also influence salary expectations.

- Bonuses: Performance-based bonuses are often offered to cost accountants as incentives to drive exceptional results. These bonuses may be tied to individual performance, team performance, or the achievement of specific financial targets.

- Equity Compensation: In some cases, cost accountants may receive equity compensation in the form of stock options or restricted stock units. This type of compensation aligns their interests with the long-term success of the organization.

- Benefits Package: Cost accountants typically receive a comprehensive benefits package that may include health insurance, dental insurance, vision insurance, life insurance, paid time off, and retirement savings plans.

A competitive compensation and benefits package not only attracts and retains top talent but also motivates cost accountants to perform at their best, contributing to the organization’s overall financial success.

FAQs on Cost Accountant Position Description

This section addresses frequently asked questions (FAQs) related to cost accountant position descriptions, providing informative answers to common concerns or misconceptions.

Question 1: What is the purpose of a cost accountant position description?

A cost accountant position description serves as a guide for hiring managers and candidates, outlining the duties, responsibilities, qualifications, and expectations for the role. It ensures clarity and alignment between the organization and potential candidates.

Question 2: What are the typical duties and responsibilities of a cost accountant?

Cost accountants analyze cost data, prepare financial reports, develop cost accounting systems, provide insights on cost behavior, and collaborate with other departments to ensure accurate financial reporting.

Question 3: What qualifications are typically required for a cost accountant position?

Cost accountant positions typically require a bachelor’s or master’s degree in accounting, finance, or a related field, along with certifications such as the CMA or CPA. Prior experience in cost accounting or a related field is also often required.

Question 4: What skills and competencies are important for cost accountants?

Cost accountants should possess strong analytical, problem-solving, and communication skills. They should also be proficient in cost accounting principles, techniques, and software.

Question 5: What is the compensation range for cost accountants?

The salary range for cost accountants varies based on experience, qualifications, industry, and location. Performance-based bonuses and equity compensation may also be offered.

Question 6: What benefits are typically offered to cost accountants?

Cost accountants typically receive a comprehensive benefits package that may include health insurance, paid time off, and retirement savings plans.

These FAQs provide a deeper understanding of cost accountant position descriptions, helping individuals navigate their career paths and organizations optimize their hiring processes.

Next Article Section: Exploring Career Advancement Opportunities for Cost Accountants

Tips for Crafting a Comprehensive Cost Accountant Position Description

A well-crafted cost accountant position description is essential for attracting and hiring the best candidates for your organization. Here are some tips to help you write a comprehensive and effective position description:

Tip 1: Clearly define the role and responsibilities.

Start by outlining the primary duties and responsibilities of the cost accountant, such as analyzing costs, preparing financial reports, and providing insights into cost behavior. Use clear and concise language that accurately reflects the expectations of the role.

Tip 2: Specify the qualifications and experience requirements.

Indicate the educational background, certifications, and prior experience required for the position. Be specific about the technical skills and competencies that are essential for success in the role.

Tip 3: Include a competitive compensation and benefits package.

Outline the salary range, bonuses, and benefits that are offered to cost accountants within your organization. Research industry benchmarks to ensure that your compensation package is competitive.

Tip 4: Proofread carefully.

Once you have drafted the position description, proofread it carefully for any errors in grammar, spelling, or punctuation. A well-written position description reflects the professionalism of your organization.

Tip 5: Regularly review and update the position description.

As your organization and the industry evolve, it is important to review and update the cost accountant position description to ensure that it remains accurate and relevant. This will help you attract the most qualified candidates and maintain a high-performing team.

By following these tips, you can create a cost accountant position description that will attract top talent and contribute to the success of your organization.

Next Article Section: Exploring Career Advancement Opportunities for Cost Accountants